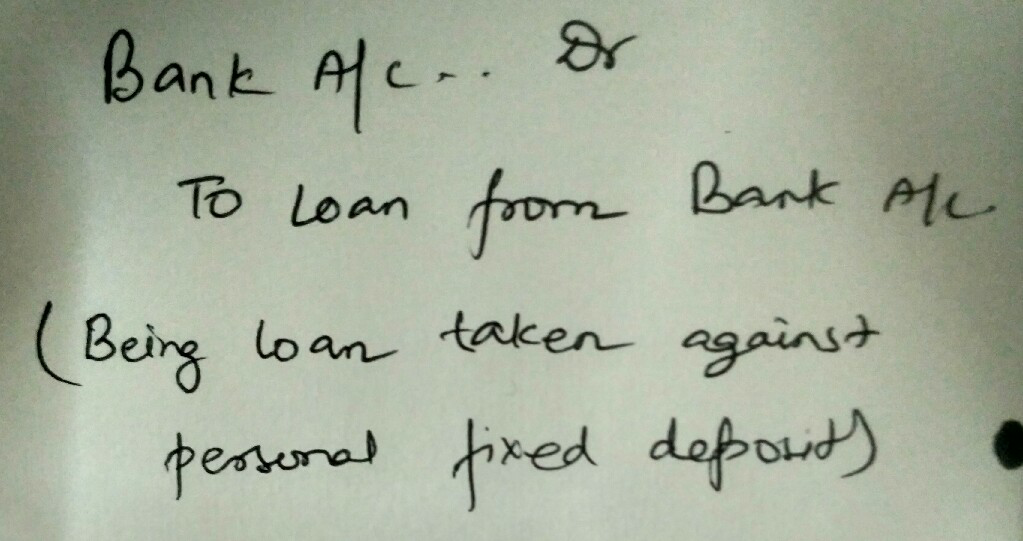

Now you have a liability and it needs to be recorded here. As such, sometimes a ‘debit’ account is referred to as a ‘cash’ account. This increases your cash balance on your balance sheet, and how much you have available to spend. You would record this loan payment to the company’s checking account. Here is how you would process the $15,000: You, as head of the bike company, should also record this. The amount is listed here under this liability account, showing that the amount is to be paid back. This means the amount is deducted from the bank’s cash to pay the loan amount out to you. The $15,000 is debited under the header “Loans”. The manager records the transaction into the bank’s general ledger as follows: The bank, or creditor, has to record this transaction properly so that it can be accounted for later, and for the bank’s books to balance. You walk out of the bank with the money having been deposited directly into your checking account.

#Personal loan forgiven journaly entry full#

You are required to pay the full loan back in two years. The manager does his analysis of your credentials and financials and approves the loan, with a repayment schedule in monthly installments based upon a reasonable interest rate. You go to your local bank branch, fill out the loan form and answer some questions. You expect moderate revenues in your first year but your business plan shows steady growth. You’ve done your due diligence, the bike industry is booming in your area, and you feel the debt incurred will be a small risk. Let’s say you are a small business owner and you would like a $15000 loan to get your bike company off the ground.

Let’s give an example of how accounting for a loans receivable transaction would be recorded. The two totals for each must balance, otherwise a mistake has been made.Ī double entry system provides better accuracy (by detecting errors more quickly) and is more effective in preventing fraud or mismanagement of funds. For every “ debit”, a matching “credit” must be recorded, and vice-versa. A double entry system requires a much more detailed bookkeeping process, where every entry has an additional corresponding entry to a different account. Like most businesses, a bank would use what is called a “Double Entry” system of accounting for all its transactions, including loan receivables. How Do You Record a Loan Receivable in Accounting? It is recorded as a “loan receivable” in the creditor’s books. What Is a Loan Receivable?Ī loan receivable is the amount of money owed from a debtor to a creditor (typically a bank or credit union). If you need income tax advice please contact an accountant in your area.

NOTE: FreshBooks Support team members are not certified income tax or accounting professionals and cannot provide advice in these areas, outside of supporting questions about FreshBooks. What Is the Difference Between Loan Payable and Loan Receivable? This is a double entry system of accounting that makes a creditor’s financial statements more accurate. Financial institutions account for loan receivables by recording the amounts paid out and owed to them in the asset and debit accounts of their general ledger.

0 kommentar(er)

0 kommentar(er)